Contribute

You do not have to be a member of the ESA Foundation to contribute designated or undesignated donations. Undesignated gifts become a part of the general fund. Designated contributions are used for the purpose designed by the donor (a specific scholarship endowment or the grant fund). All contributions are tax deductible. To make a donation to the ESA Foundation, please follow the steps below or click here to download the latest paper contribution form (reminder: this form is updated often so please download a fresh form each time you would like to donate).

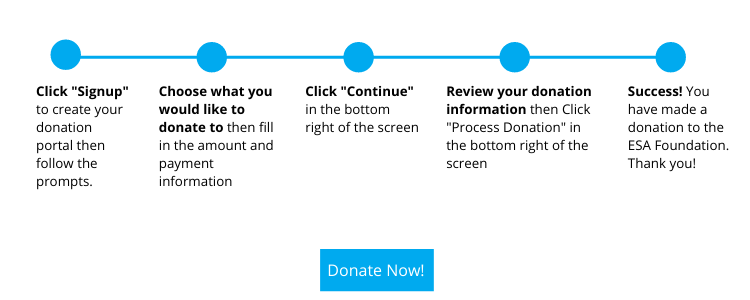

Create a Donation Portal and Donate to the ESA Foundation:

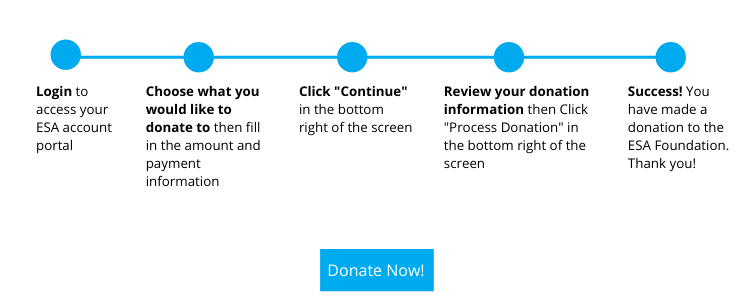

Login to an Existing Donation/Membership Portal to Donate to the ESA Foundation:

If you would prefer to mail a check, please use the Contribution form (pdf) or call ESA Headquarters: 970.223.2824.

An ESA Foundation membership is separate from a membership to ESA. Anyone can be a member of the ESA Foundation by following the steps provided below.

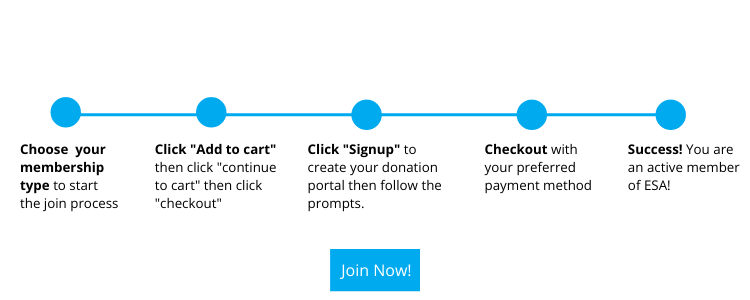

New to ESA and the ESA Foundation:

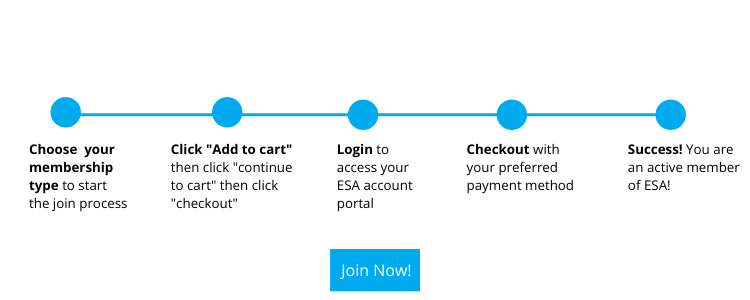

ESA Member Becoming an ESA Foundation Member:

If you would prefer to mail a check, please use the

Contribution form (pdf) or call ESA Headquarters: 970.223.2824.

Other Ways to Contribute

Looking for a way to serve the ESA Foundation mission in other ways?

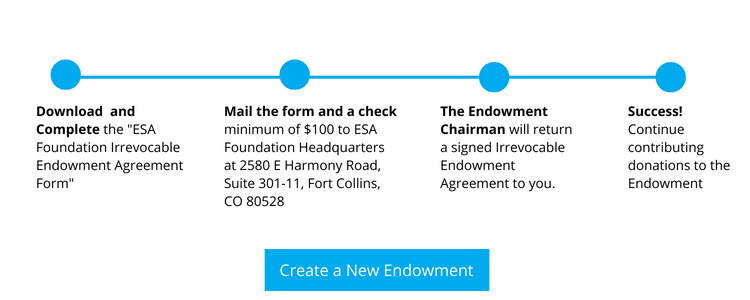

The ESA Foundation encourages the promotion of the establishment of endowments. You may honor an individual or group who has made outstanding contributions to the ESA Foundation, to ESA International, to an ESA State Council, ESA Regional Council, or to the community. This may be as a memorial or an honorarium endowment. Endowment Agreement Guidelines

*The endowment is fully endowed when the balance in the account reaches $5,000.

**All accounts will be maintained with a Restricted Account Principal of $5,000 and all additional monies will be placed in the available account balance.

To update criteria for a current endowment, please use this form.

To update contacts for a current endowment, please use this form.

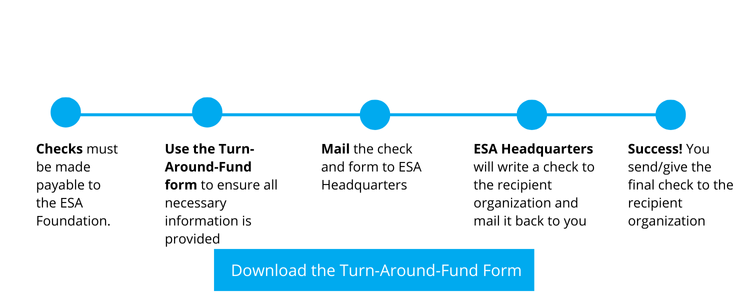

The Turn-Around Fund is that portion of the ESA Foundation that enables members of the Foundation to obtain contributions from businesses / individuals to contribute to charitable projects / organizations. Depending on the status of the donor, these contributions may be tax deductible. The Turn-Around Fund consists of externally funded grants. The ESA Foundation Turn-Around Fund may be used by the ESA Foundation memberships or outside entities.

In accordance with the IRS guidelines, the following criteria must be true to use the ESA Foundation Turn-Around-Fund:

- Checks sent to the Turn-Around Fund must be made payable to the ESA Foundation.

- Checks or donations must be for $25 or more.

- ESA Foundation Turn-Around Fund checks may only be issued to other IRS designated 501(c)3 charitable organizations. The recipient entity’s 501(c)3 valid determination or exemption letter, and EIN # must accompany the request. [See note below]

- ESA Foundation Turn-Around Fund checks not cashed within 120 days of the date of issue will be considered a donation to the ESA Foundation General Fund.

- The IRS does not allow the following:

- Turn-Around checks issued directly to an individual or reissued to a chapter or state council.

- ESA Disaster Fund

- State / Regional Love or Care Funds

NOTE: The EIN # for St. Jude Children’s Research Hospital is 62-0646012. A list of 501(c)3 approved organizations will be compiled, updated as needed, and accessible through the ESA Foundation website.

If you are uncertain about your charity / organization, you can check them out on the following website: www.guidestar.org. This site lists almost all IRS authorized 501(c)3 entities.

Planned giving is a great way for you to benefit charitable causes while you still leave sufficient funds for your loved ones. Whether you donate through your will, a trust, investments, life insurance, or retirement plans, planned giving is an opportunity to provide for your loved ones, fulfill your charitable goals, plus save money on taxes. If you wish to proceed with a gift, or you have any questions, please contact ESA Headquarters: 970.223.2824.

What do you need to know?

The most important things you need to know about planned giving are the options available to you and the benefits of each. While all methods are excellent opportunities to give to the ESA Foundation and receive tax benefits, certain venues can fit your circumstances better than others.

What are your options?

Options include: wills, bequests, beneficiary designations, IRA distributions, edowments, and other charitable planning alternatives.

For details on planned giving options, please refer to the following documents:

No matter what the size of your gift or estate, any donation you can make will make a significant impact on the world community. Remember:

Annual gifts can change lives today.

Planned gifts can change lives forever.

(The ESA Foundation does not provide tax advice. Don’t forget to always consult your tax advisor.)